do you pay taxes on a leased car in texas

However if you rent out the leased equipment without operating it yourself a sales and use tax applies. In Texas all property is taxable unless exempt by state or federal law.

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

Since leased vehicles produce income for.

. Property taxes on the vehicle are not applicable for the lessee. Texas is the only state. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas.

In the state of Texas you pay 625 tax on Trade difference Example. Property taxes on the vehicle are not applicable for the lessee. Some dealerships may charge a.

Although most states only charge sales tax on individual monthly payments and if applicable down payments some states including Texas New York Minnesota Ohio Georgia and. Since leased vehicles produce income for the leasing. Technically there are two separate transactions and Texas taxes it that way.

In some states such as Georgia you pay a title ad valorem tax up front on the capitalized lease cost or lease price see Georgia Car Lease for recent changes. Lease payments are not taxed in Texas. Only the service is charged tax.

In a couple states such as Texas lessees must pay sales tax on the full value of the leased car what you described as the original price versus just the tax on payments. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor. In Texas all property is taxable unless exempt by state or federal law.

There are some available advantages to leasing a vehicle in a business name please. Car youre buying 50000 Car youre trading 30000 Trade Difference 20000 Taxes. The lessor pays 625 percent motor vehicle sales tax when the vehicle is purchased and titled in Texas.

Items are leased with no intent to purchase at the end of the lease. In a couple of states such as Texas lessees must pay sales tax on the full value of the leased car versus just the tax on payments during the time of the lease. Yes in Texas you must pay tax again when you buy your off-lease vehicle.

Tax typically will be due on each lease payment. Lease payments are not taxed in Texas. The taxable value of private-party purchases.

While leasing gives you the opportunity to drive a car with the latest. Texas laws require that the lessor the lease company pay sales tax on the full value of any vehicle they buy from a dealer and lease back to a lessee you and me. When you lease a car you pay for the vehicles depreciation during the course of the lease plus interest.

The lessor is responsible for the tax and it is paid when the vehicle is registered at the local county tax. Any tax paid by the. For vehicles that are being rented or leased see see taxation of leases and rentals.

In other states such as Illinois. Texas collects a 625 state sales tax rate on the purchase of all vehicles. A motor vehicle purchased in Texas to be leased is subject to motor vehicle sales tax.

No tax is due on the lease payments made by the lessee under a lease agreement. All leased vehicles with a garaging address in Texas are subject to property taxes. What kind of taxes do you pay on a.

The lessor pays 625 percent motor vehicle sales tax when the vehicle is purchased. Do you pay sales tax on a lease buyout in Texas.

U Haul Rental Agreement Form 1 Moments That Basically Sum Up Your U Haul Rental Agreement Fo Rental Agreement Templates Lease Agreement Lease

Nj Car Sales Tax Everything You Need To Know

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Gift A Car A Step By Step Guide To Making This Big Purchase

Do You Pay Sales Tax On A Lease Buyout

Leasing Vs Buying A Car Which Offers More Tax Savings Turo Tax Tips

The Fees And Taxes Involved In Car Leasing Complete Guide

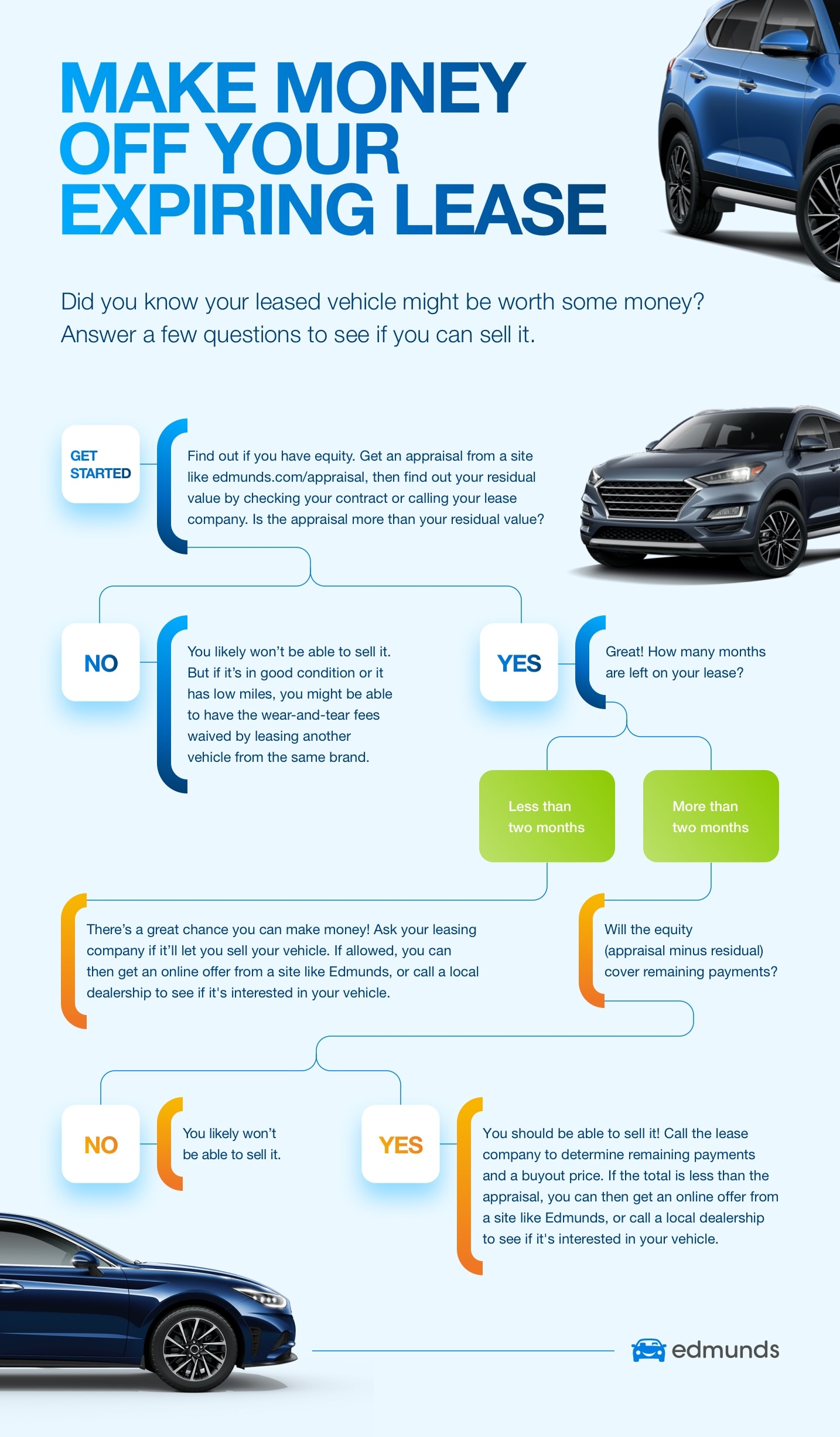

Consider Selling Your Car Before Your Lease Ends Edmunds

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Auto Sales Are Down Here S Why They Ll Continue To Fall Cars For Sale Car Auctions Car

Car Leasing Costs Taxes And Fees U S News

The States With The Lowest Car Tax The Motley Fool

Car Financing Are Taxes And Fees Included Autotrader

Are Car Repairs Tax Deductible H R Block

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Texas Car Sales Tax Everything You Need To Know

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price