food tax in maine

Rates include state county and city taxes. Today the RSLC released a video about the pet food tax hike that Augusta Democrats passed.

Don T Fall For The Seasonal Gas Tax Gimmick The Maine Wire

Sales Tax Calculator Sales Tax Table.

. This state has special 8 sales tax rates for lodging. It is written in a relatively informal style and is intended to address issues commonly faced by persons such as supermarkets grocery stores and. In the state of Maine legally sales tax is required to be collected from tangible physical products being sold to a consumer.

Businesses making retail sales in Maine collect sales tax from their customers on. Maine State Retail Sales Tax Laws. Maine state retail sales tax laws.

The Maine Republican Party is the states premier political organization supporting. For example sales of containers of. Several examples of exceptions to this tax are most grocery.

Retailers can then file an amended return at a later date to reconcile the correct tax owed. Copies of sales receipts should be kept to. Prepared food containing Medical Marijuana is subject to tax at 8.

Retail sales tax is the state of Maines principal tax source. This page describes the taxability of. Food and supplies essential to the care and maintenance of seeing-eye dogs used to assist blind people are exempt from sales tax.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries. They did this despite the fact that just about everything is ridiculously expensive right now in part because of. Store all sales that are made from the restaurant facility are subject to tax at the prepared food rate even if the overall facility does not meet the 75 rule.

Pet food tax hike stopped in its tracks. The maine sales tax rate is 55 as of 2022 and no local sales tax is collected in addition to the me state tax. Maine ME Sales Tax.

While Maines sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The Maine House Democrats just passed a pet food tax hike. If you have any questions please contact the MRS Sales Tax Division at 207 624-9693 or.

2020 rates included for use while preparing your income tax deduction. About the Maine Sales Tax. Mills desk by legislative.

The Maine Democrats Pet Food Tax Hike bill has been recalled from Gov. Exemptions to the Maine sales tax will vary by state. Obligations under Maine tax law.

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. Start filing your tax return now. The state of Maine has a simple sales tax system and utilizes a flat state tax rate that was last raised in 2007.

Returns are due no later than the 15th of the month. TAX DAY IS APRIL 17th - There are 176 days left.

Historical Maine Tax Policy Information Ballotpedia

Me Income Tax Deadline Extended Food Banks Boating And Fishing News Maine Responds More

Luncheon Specials Green Leaves Chinese Restaurant Japanese Restaurant And Lounge Of York Maine

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Sales Taxes In The United States Wikipedia

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Budget Archives The Maine Wire

A Tax Day Event Veterans For Peace Maine

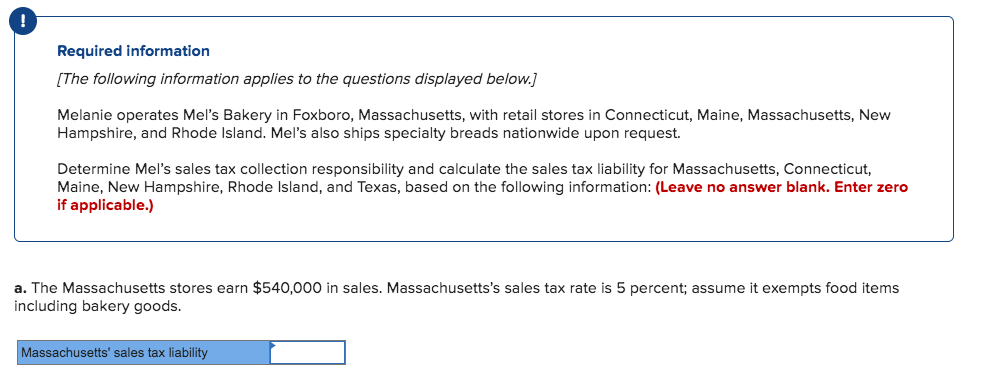

Solved Required Information The Following Information Chegg Com

Maine Sales Tax Calculator And Local Rates 2021 Wise

Cei S 2020 Impact Supporting Businesses In Their Efforts To Stay Open During The Pandemic Creating Or Saving 600 Jobs Cei

Maine Sales Tax Small Business Guide Truic

How Much Is A Business License In Maine Licensecost Com

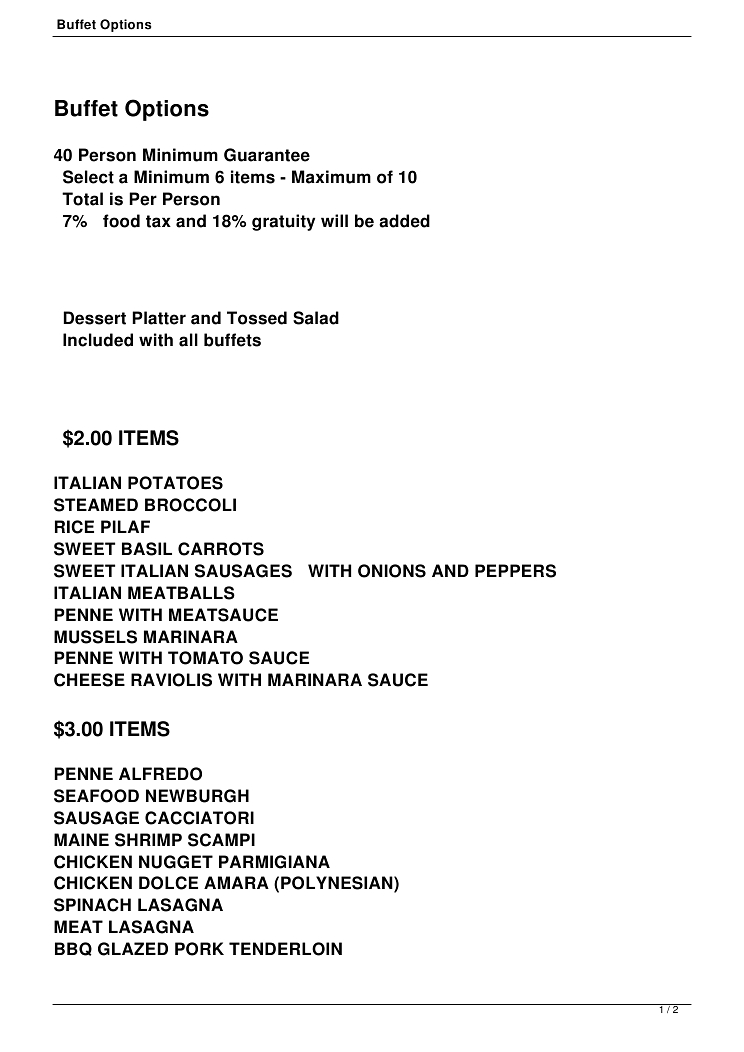

Marcos Restaurant Lewiston Maine Catering Buffet Lewiston Auburn Maine Restaurants Lewiston Auburn Maine Restaurants

I Team Maine Excise Tax Among The Highest In Us How Is That Money Spent Wgme

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes